Before online job sites OfferUp, Craigslist, and UpWork, there were newspaper classifieds. As in, printed newspaper classifieds. People and companies purchased small sections in a paper to advertise service, products, post job listings, and, yes, even dating! You could use newspaper classifieds for just about anything (legal, of course).

In the modern day, classifieds still exist, but it’s far more common to use the internet to access classified-type listings than a newspaper. Online classified sites like Craigslist or apps like OfferUp are used for similar purposes but are more frequently updated and easier to post on than a newspaper classified. Not to mention, many of these services are free.

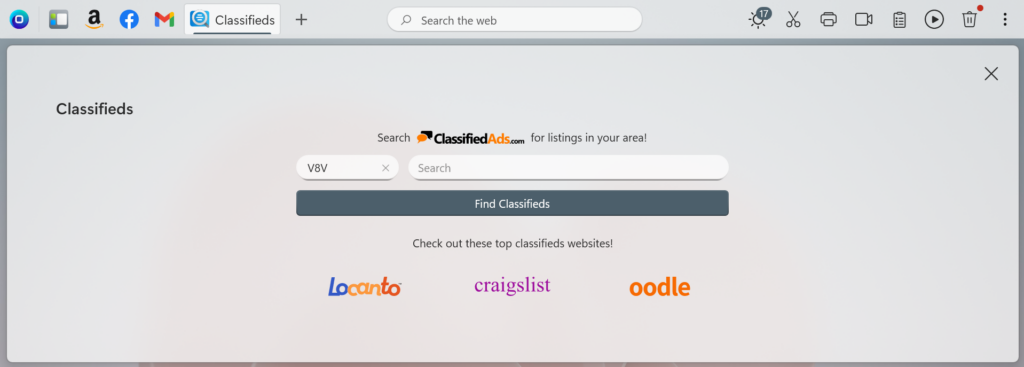

For more updated online ClassifiedAds, check out the OneLaunch Classifieds app, which lets you search classifieds by ZIP code to find advertisements and jobs in your area. This app is easy to use and can be directly pinned to your OneLaunch dock for repeated use.

But, as the internet makes it easier to do business online, it also makes it easier for bad people to post fake advertisements and scams to cheat people out of their money. We’ve gathered information about common classified scams and how to spot them. We’ll also cover common red flags to look out for in online scams.

Job Scamming

Online classifieds can be a great place to find work or post about employment opportunities in your local community. However, it’s become increasingly common for scammers to post a fake job to steal your personal information or money. The FTC states that some of the most common employment scams involve jobs that are “too good to be true.” The promise things like working from home, making a lot of money, setting your own schedule, and being your boss.

These scammers dangle these highly valued qualities to tempt prospective applicants to apply. They then either secure your personal information during the onboarding process (when you sign up for payroll) or make you pay for an expensive “training kit” or “required training course” that isn’t really for any job.

Other common employment scams include:

- Reselling/reshipping scams

- A position where you receive packages, repack them, and then ship them elsewhere. These goods are usually purchased with stolen money or credit cards and will likely never pay you for your work.

- Mystery shopper scams

- Legitimate mystery shopper companies won’t require you to earn a certification, pay for a job directory, or anything else to get started.

- Job placement scams

- A legitimate placement firm or temporary agency won’t require you to pay a fewer to get a job

Watch out for:

- Prospective employer promising too much (AKA, too good to be true)

- Someone overpaying you with a check for your services and asking you to pay them back the difference

- Paying for certification or course to get a job

- Buying products to resell to others — this is likely a pyramid scheme

Selling Scams

If you’re selling something through digital classifieds, you must watch out for a potential scammers. In particular, high-value items like cars often have a lot of potential scams attached. However, even with cheaper items you can potentially be the target of a scam. When selling something, pay special attention to the buyer’s profile. Check if they have a history of other transactions and how new the account is.

Common selling scams to look out for:

- Overpayment scam

- This common scam involves the scammer “accidentally” overpaying you for an item you’re selling and asking you to send back the difference. The money they send you “bounces” and you end up losing the difference.

- Meeting at your home

- If you’re selling an item, it’s far safer to meet at a public place or a designated e-commerce safe zone that’s recorded with cameras. Even if you successfully sell something, a potential buyer may be “scoping out” your home to potentially rob in the future. Don’t answer personal questions like, when are you away from home, where do you work, or if you’re going on vacation soon.

- Online payments

- Many sellers prefer to use cash because of how common it is for online payments not to go through. A payment through a money order, transfer, credit card, or PayPal can appear to be successful but end up not going through.

Watch out for:

- People being too aggressive with the purchase, wanting to meet at a specific place or at a specific time

- Meeting requests at night

- Someone insisting on paying you in a way other than cash (gift cards, money order, check, etc.)

- Buyers that refuse to meet in person, insist on you shipping the item

- Never provide any personal information

Buying Scams

Just as when you sell something, you also have to watch out for scams when buying something through online classifieds. As with the selling scams, you need to look out for newer accounts that don’t have a lot of transaction history. Many online classifieds will have a system for reporting potential buyers, so do this if you sense someone is trying to scam you.

Common buying scams to look out for:

- Fake product or advertisement

- If a seller doesn’t have photos of the item for sale, or can’t answer questions about the item itself, it’s probably not theirs. If you don’t have the opportunity to inspect the item in person, you probably shouldn’t purchase it. Reverse image search pictures on the post on Google if you’re worried that the pictures the seller has aren’t real.

- Delivery scams

- If a seller offers to deliver a product like an appliance or a piece of furniture for you with the condition that you need to put down a small payment to secure the item, this is likely a scam. This is especially true if they won’t let you inspect the item in person. They’ll take your money and never bring you the product.

- Sending money outside the classified

- If you’re using an online classified service with an internal payment system for buying items, beware of sellers who insist on going through a third-party app instead. This probably means that they’re trying to take your money without giving you the item you wanted.

Watch out for:

- Sellers that won’t let you inspect the item you’re buying

- Non-secure payment methods like gift cards or cryptocurrency

- Sellers that don’t want to talk through the classified

- Items priced ridiculously low and other “too good to be true” posts

Rental/Property Scams

If you’re perusing online classifieds for renting a home temporarily or long-term, you’ll need to watch out for rental scams. Because historic information is out there about properties, it’s common for scammers to “hijack” someone else’s property and pretend to be the owner to steal your security deposit.

In this scam, a scammer takes pictures from a property they find online and posts it on classifieds pretending to be the owner wanting to rent the property. The scammer then makes an excuse for why you can’t see the property in person and asks you to put down a downpayment by wiring them money. They’ll steal this downpayment, and you’ll never hear from them again.

Never put anything down on a property or agree to something that you can’t see in person. If you or someone you know can’t check out the property, such as with a short-term vacation rental, you can search online for the property’s address and get information about the owner or rental company. If the owner doesn’t match the name of the person you’re contacting, it’s likely a scam.

Watch out for:

- Rent that’s way too low for what the property is worth

- Excuses for why you can’t tour the property

- “Landlords” that want you to wire transfer money

- Pictures that match the images on a property site like Zillow (again, try the reverse image search)

General Red Flags of Online Classifieds

Rushing/urgency

Scammers like to create a false sense of urgency to rush victims into an irrational decision. They’ll say that they’re “about to accept another offer” or are “about to back out” so that you’ll make a split-second decision that you regret. If a buyer or seller is threatening to back out of a sale because you want to be cautious, assume they’re a scammer. Don’t let someone bully you into a transaction you’re not comfortable with.

Asking to wire money

Wiring money is essentially the same as giving someone cash. Once it’s gone, it’s gone forever. When a scammer insists that you wire them money before you can see the item or property, they’ll probably take the money and run. If you absolutely must wire someone some money, check the wire information that they provide to make sure the name and number match their name and bank information.

Transactions with checks

Checks are a common tool that scammers use to cheap people out of their money. When you cash a check, it can appear to go through to your account before the transaction is verified. If the account that the cash is coming from is empty, the check will “bounce” and the money will disappear from your account. Some other scammers will use fake cashier’s checks to pretend to give you money.

Third-party agents stepping in

If, during a transaction, the person you’re dealing with wants you to send money to some third party rather than directly to them, they’re probably trying to scam you. If the buyer or seller insists on going through a third-party app for payment, this is also likely a scam where you give them personal information and/or money.

Accessing a link through text/email

A scam may be as simple as a link to a website that you receive through text or email from a scammer. In this case, while talking with the scammer through the online classified platform, they’ll want to communicate over text or email where they can send you links. They’ll send you a link to a website with an excuse why you need to click it, and the website will either attempt to download a virus or steal your personal information.

Scammers may also create identical copies of other websites to trick victims into giving away their personal information. Read the URL carefully!

Share On Twitter

Share On Twitter