9 Apps That Help You Save Money

Saving money isn’t easy, especially as living costs remain high. With food prices predicted to increase by 2.5% and mortgage rates hovering just over 7%, keeping some green in your wallet can prove challenging. The good news is, there’s an app for that. Several apps can help you save money. Here, we explain banking, budgeting, and cash back apps that can help you hold on to your money.

How Do Money Saving Apps Work?

A quick Google search will display over 40 money saving apps. We have selected 11 money-saving apps that work on both Apple and Android mobile devices. So, how do money saving apps work? It depends on the purpose of the app. For example, banking apps focus on managing your finances, whereas using cashback or rebate apps will earn you money back after making specific purchases.

All investments come with some degree of risk. They may also offer tax advantages. None of this should be mistaken for financial advice; we leave that to qualified financial and legal advisers. We present this list of apps and how they work to help you get started. Always do your due diligence before entrusting your personal information and finances to anyone.

Banking Apps

Banking or investing apps require you to set financial goals and link financial accounts such as your checking and/or savings account or credit and debit cards.

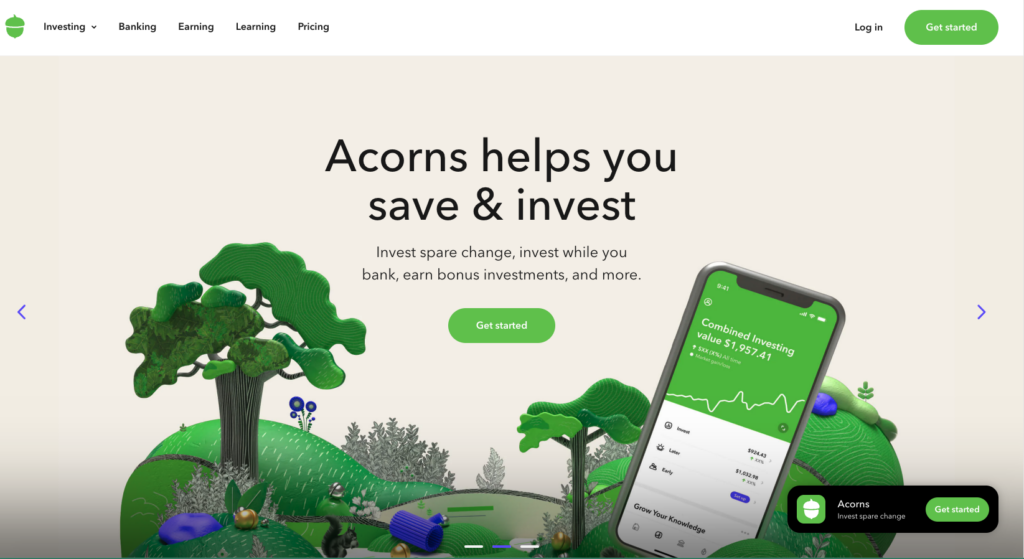

Acorns

Acorns is a subscription-based app that helps you save money through four options.

Acorn Invest is an automated investment app that will invest your spare change into an ETF (an exchange-traded fund that can include stocks and bonds) when you use your debit or credit through the Acorns Round Ups feature (Acorns rounds up your purchase to the nearest dollar). Or, you can set up recurring investments (as little as $5) every day, week, or month.

Acorns Later is an IRA plan (Roth, traditional, or SEP) that you can set up with automatic contributions starting at 1% of your paycheck.

Acorns Checking features direct deposit, no minimum balance, and no overdraft fees. Plus, you can earn bonus investments when you use your Acorns Visa debit card (which comes with your Acorns Checking account) at select retailers.

Acorns Early allows you to invest as little as $5 on a recurring basis (day, week, or month) in an account for your child(ren). This investment account is a uniform transfer/gift to minors (UTMA) account. That means it is the child’s property and can be used for anything once they come of age (either 18 or 21, depending on the state).*

- Acorns Personal $3/month: Includes Acorns Invest, Acorns Checking, and Acorns Later

- Acorns Personal Plus $5/month: Includes all the above and Acorns Early

- Acorns Premium $9/month: Includes $10,000 life insurance, and you can set up a basic will for free.

Chime

Chime is a free banking app that can help you save money with no-fee checking and savings accounts (no monthly fees, transaction fees, or overdraft fees), a Chime Visa debit card, and an optional secured (no fee) Chime Credit Builder Visa credit card to help build credit.

If you sign up for a Chime checking account, you can link an external bank account to transfer initial funds to your new account or deposit cash (without fees) at any Walgreens location. Then, you can set up your Chime account to directly deposit your paycheck up to two days early.

If you open a Chime savings account, you can round up your Chime debit card purchases to the nearest dollar and transfer the difference to your savings account. You can also opt to have a percentage of each paycheck automatically transferred to your savings account.

(How does Chime make money? They explain in a blog post that they make money through interchange fees. Also known as “swipe fees,” these fees are paid between merchants and card issuers; by facilitating the transaction, Chime takes a portion.)

Budgeting Apps

Budgeting apps can help you create a budget, see where your money is going, and save money monthly.

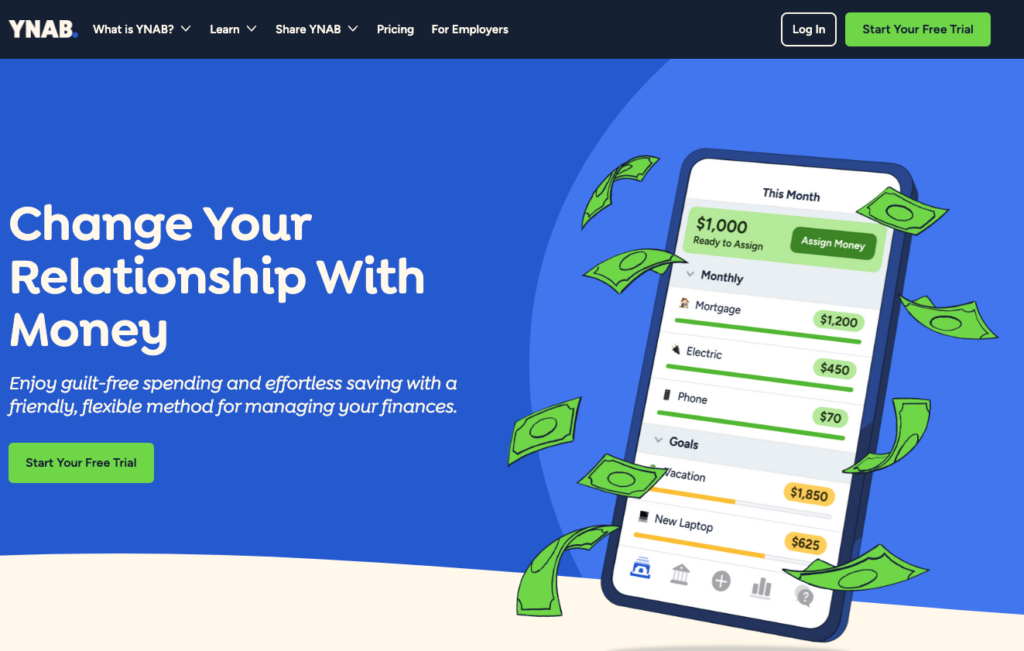

You Need a Budget (YNAB)

You Need a Budget, also known as YNAB, is a subscription-based budgeting app that helps you create a budget based on four rules:

Give Every Dollar a Job: You will assign your money (every time you earn it) to tasks like paying the mortgage or buying groceries.

Embrace Your True Expenses: You must set aside an amount each month and divide it into specific non-monthly expenses, such as car repairs or holiday spending.

Roll With The Punches: If your priorities or circumstances change, you can adjust your budgeting plan to accommodate.

Age Your Money: You want to get to the point where the money you’re currently spending is from at least 30 days ago.

- Monthly plan: $14.99/month

- Annual plan: $99 paid annually (which works out to $8.25/month)

YNAB offers a 34-day free trial.*

Goodbudget

Goodbudget is a budgeting app based on the envelope method. You will make digital envelopes for all your budgeting categories, such as mortgage, groceries, utilities, car payments, etc. You set aside enough money for each envelope every month before spending anything. Once the money is gone from an envelope, you can’t spend any more on that category. For example, if you have an entertainment envelope with $100, that’s all you can spend for the month.

Goodbudget offers a free version of the app, which includes:

- 10 regular envelopes

- 10 more envelopes

- 1 account

- 2 devices

- 1 year of history

- Debt tracking

- Community support

Goodbudget has a paid premium version ($10/month or $80/year) if you decide the free version isn’t enough for your budgeting needs. This option includes unlimited envelopes, the ability to sync to your bank automatically, and a few other benefits like seven years of history.

Qapital

Qapital is a money-saving budgeting app. You must link a checking account, PayPal account, or credit card to the app and set up your savings goal. Qapital will then automatically transfer money based on your selected rules (see below) to an FDIC-insured savings account through a Qapital partner bank.

Set & Forget Rule: You can automatically transfer money to your Qapital savings account daily, weekly, or monthly.

Round-up Rule: Round up your credit card purchases to the nearest dollar (up to $5) and transfer that amount to your Qapital account.

Guilty Pleasure Rule: You can automatically save a certain amount (that you determine) whenever you buy something you’re trying to resist, like your Panera lattes.

Spend Less Rule: Select merchants (CVS, Starbucks, etc.) for which you regularly shop and set a budget. If you spend less than what you budgeted, the difference will transfer to your Qapital account.

Freelance Rule: Set a minimum deposit and the percentage you want Qapital to deduct from every deposit made and transfer to your Qapital account.

52-Week Rule: Save an amount based on the week of the year. For example, save $1 for week one, $2 for week two, and so on. After 52 weeks, you will have set aside $1,378.

Apple Health Rule: If you’re an Apple user, you can set up Qapital to automatically transfer a set amount to your Qapital account whenever you meet a health goal, such as for steps, workouts, walking/running distance, etc. For example, you can have Qapital deposit $5 when you walk 10,000 steps.

- Basic runs $3/month: This option includes the Rules feature discussed above.

- Complete is $6/month: This option allows you to invest with Qapital.

- Premier: $12/month: This option allows you to save with a partner.

Note: Qapital offers a 30-day free trial to check it out before jumping all in.*

Cash Back Apps

Cash back or rebate apps help you earn money on purchases. Some cashback rebate apps require you to shop for specific items to meet an offer’s requirements, or shop through the app itself. Other cash back apps only require you to submit a copy (take a photo with your cell phone) of your receipt to earn your cashback.

How do cash-back apps make money? When it comes to “free” apps, we recommend that consumers read the terms and conditions. In fact, any time a technology company offers something for free, find out how they earn revenue. Some do it through in-app advertisements, while others do it by collecting data and selling it to third parties. Make sure you are comfortable with their business models before you entrust them with your information.

Ibotta

Ibbota is a free cashback app that allows you to earn on in-store and for online purchases. After you create an account, you can select your favorite retailers and add offers (tap the plus sign next to the item) to your Ibotta account. Next, you’ll need to redeem the offers in store or online and submit a picture of your receipt. You can link your loyalty account at certain retailers, such as Walmart, with your Ibotta account. Once linked, you won’t have to submit a receipt (Ibotta will automatically load the receipt info). When you reach a minimum of $20 in Ibotta earnings, you can withdraw them to your PayPal account or a gift card (Starbucks, Amazon, and more).

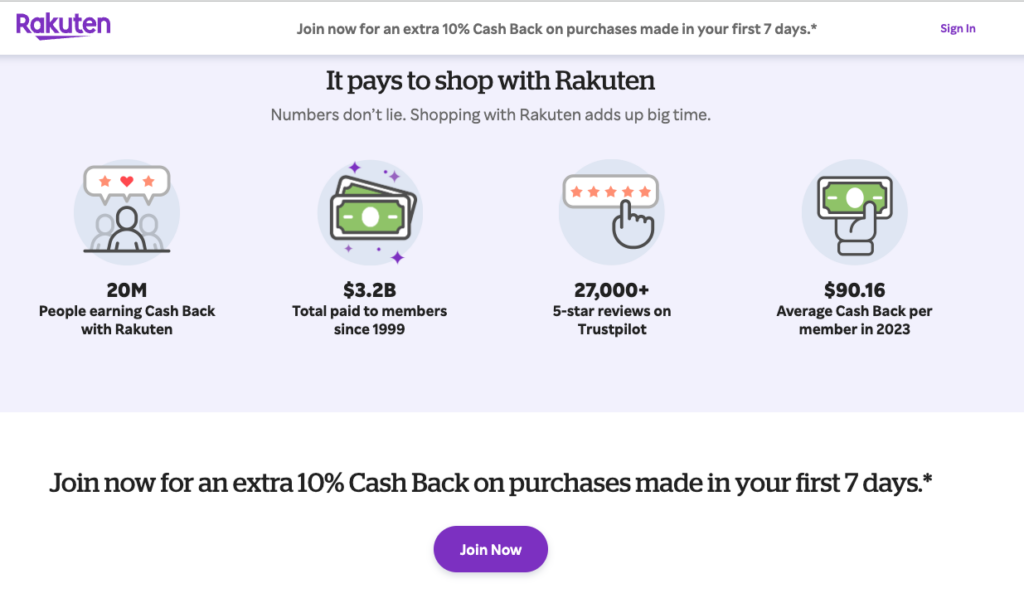

Rakuten

Rakuten is a free cash back app that you use to shop online through their app or in stores near you. Retailers pay Rakuten a commission that Rakuten then shares part of with you when you make a purchase at one of the 3,500 stores they have in their list of partners. You can search Rakuten by category (clothing, auto & tires, etc.), retailer name, or product(s).

To shop through the app, tap on a retailer, and Rakuten will send you to the retailer’s website. If you wish to shop in-store, click the In-Store icon at the bottom of the home screen and click Add by each offer you want to redeem in-store. Rakuten will verify your purchase with the retailer and add your cashback to your Rakuten account. Once you reach a minimum of $5.01, you’ll receive a check in the mail or through your PayPal account on the next payment date (which occurs four times a year). If your earnings are $5 or less, you’ll have to wait until the following payment date:

- February 15

- May 15

- August 15

- November 15

When you add the Rakuten Cash Back Button browser extension to Chrome, Rakuten works in the background to find any offers for the website you’re on. If there are current deals, Rakuten will display what offers are available and automatically apply any coupons at checkout. Any earnings through the Rakuten Cash Back button will accumulate with your other Rakuten earnings and payout according to the payment schedule above.

Fetch Rewards

Fetch is a free cash back app that lets you earn points in a few ways:

- When you upload an image of your in-store receipt

- When you link your Walmart, Amazon, or email account

- When you scan any receipt (from any place: restaurant, gas station, grocery store, etc.) and get 25 points (you can submit up to 35 receipts within seven days)

- If you refer a friend (for 1,000 points)

- When you join a club, such as General Mills or Huggies, to receive exclusive offers

- When you purchase a qualifying brand from their Special Offers category

When browsing through stores in the Fetch app, you will notice how many rewards (coins) you’ll earn on each item, plus any specific size, flavor, etc., information. It will also show if you have to buy the item at a specific store. Once you reach 3,000 points (worth $3), you can cash out your earnings (tap the Rewards button at the bottom of the Fetch app) as a gift card to Amazon, Starbucks, Bath & Body Works, and many other retailers.

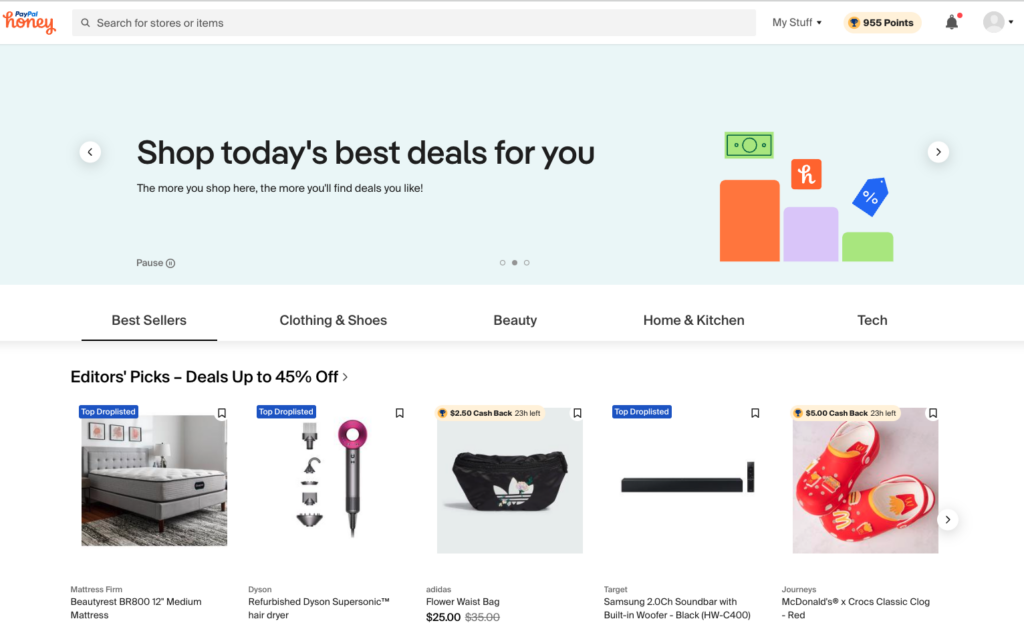

Honey

Honey is a free Chrome browser extension owned by PayPal. Instead of searching for discount codes and coupons for a retail website, Honey finds them for you and displays the number of applicable deals, including sales. A few things to remember, before you shop online, click the Activate Cash Back button when Honey has a cashback offer for you. During checkout, click the Apply Coupons button, and Honey will automatically apply any available coupons to your cart.

If you like to shop on Amazon, Honey can compare Amazon items, including shipping costs and deals. Plus, this browser extension will show you an item’s price history (up to 120 days) to give you an idea of whether you’re getting a good deal.

Anytime you find items but aren’t ready to buy, you can add them to the Honey Droplist. Then, when a price drops, Honey will notify you via email. To add an item to the Droplist, make sure you’re on the product page you want to save. Click on the Honey icon at the top of the webpage, scroll down, and click the Add to Droplist button. If an item has various color or size options, select your preference and click Save item.

You’ll earn Honey points for every eligible purchase (that you can view in your account when you click the Honey icon next to your Chrome address bar). After you earn $20 (20,000 points), you can cash out to either PayPal or a retailer gift card.

Note: You can also use Honey for other browsers, including Microsoft Edge, Firefox, Opera, and Safari.

*Fees and prices from these apps are as ove April 2024. Terms subject to change.

Share On Twitter

Share On Twitter