What Are P2P Apps & How Do They Work?

Peer-to-peer (P2P) payment apps allow people to digitally send and receive money (using a bank account, debit card or credit card) to each other without going through a bank. Payments are often instant and can be made between the sender’s and receiver’s bank accounts or payment methods via a mobile app or website. The P2P app eliminates the need to share personal bank information with other people. To use the P2P app, you create a P2P account, link your bank to the P2P site or app, and create a username. Typically, that’s how other users find you — through your username, email address or phone number.

Security and fraud protection vary among apps, but payments are usually protected similar to debit card transactions, with peer-to-peer cash apps requiring passwords/PINs and sometimes additional authentication like fingerprint or facial recognition.

We’ll look at 6 P2P apps and then explain how you can protect your finances when using these apps.

6 Best Cash Payment Apps

Venmo

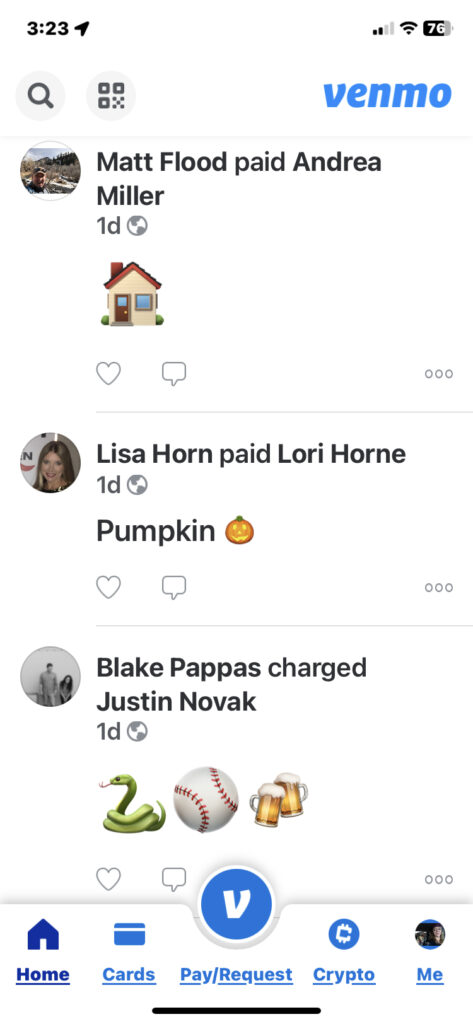

Venmo is a peer-to-peer cash payment app that is owned by PayPal. It allows you to link your bank account or debit card to send and receive payments through its mobile app or website. To send money, you’ll need to link Venmo to your debit card, credit card, prepaid cards or bank account. One of the main draws of Venmo is its social features — you can publicly share payments on your profile, so friends can see who paid for dinner or a concert ticket. People can like or use emojis for posted transactions (similar to liking posts on social media). To be honest, we aren’t sure we get the allure of sharing financial transaction information like this, as it can be a security concern. Venmo hides the dollar amount, but shows who paid whom and for what. Venmo doesn’t charge fees for personal payments among friends. If you’re selling goods or services through Venmo, they will charge fees. Here is a link to Venmo’s “our fees” page.

PayPal

PayPal launched in 2000, making it the oldest of the peer-to-peer cash payment apps. It allows you to link multiple funding sources including bank accounts, debit cards, PayPal Cash, PayPal Credit, and international currency accounts. PayPal enables online shopping, bill splitting, and domestic or international money transfers. For personal payments between individuals, there are no transaction fees. Although PayPal is widely accepted across online retailers and digital services, it doesn’t have the social features of Venmo. Paypal is one of the most-spoofed brands in phishing scams, so be sure to follow safe practices when using PayPal. For example, rather than clicking a link in an email or text message that appears to be from PayPal, open the app on your phone or computer and sign in to check for activity or messages. Report suspicious activity to PayPal.

Cash App

The Cash App is a popular peer-to-peer app that allows you to send and receive money. You can also buy and sell Bitcoin. To use the Cash App, you must link a bank account, debit card or credit card to deposit funds. Cash App also offers the ability to withdraw funds directly to a connected bank account. There are no fees for personal P2P transfers between friends. However, Cash App does charge a 0.5% -1.75% fee (a minimum $0.25) for instant deposit and $2.50 per ATM (in and out-of-network) withdrawal. Here is Cash App’s P2P fee information.

Zelle

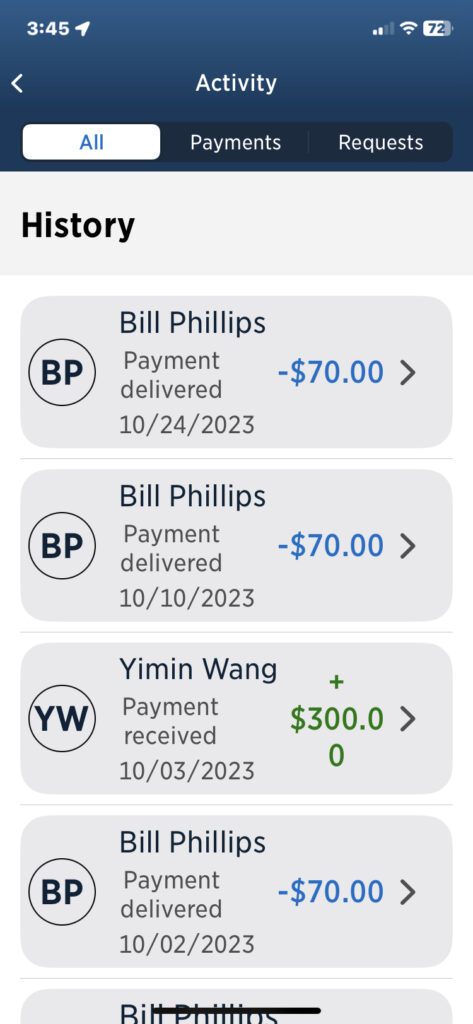

Unlike Venmo, Cash App and PayPal, Zelle works through your bank. Zelle is a digital payment network operated by several large US banks (Bank of America, JPMorgan Chase, Wells Fargo and others). It allows you to send and receive money from your linked bank account directly within many banking apps and websites. Because it uses the existing banking infrastructure, money sent via Zelle arrives within minutes into a recipient’s bank account. While there are no fees for personal Zelle payments, it’s limited to bank account transfers and cannot be used to pay businesses or merchants.

Apple Pay

Apple Pay allows money transfers between iPhone and other Apple device users through messages or the Wallet app. Payments are usually received instantly. To enable withdrawals, it is necessary to link your bank or credit card to Apple Pay. There are no fees for personal P2P transfers using Apple Pay. Note, the recipient must also have a bank account added to Apple Pay to receive money.

Google Pay

Similar to Apple Pay, Google Pay enables users with compatible Android devices to send and receive money through the Google Pay app by entering the recipient’s phone number or email address. Funds are deducted directly from your linked bank or card. For personal transfers, Google Pay doesn’t charge fees. However, availability and functionality may vary depending on a user’s mobile carrier or bank, since Google Pay must connect with other financial institutions. Recipients must also have a Google Pay account to receive money.

P2P Fraud Prevention Features

To help keep your money and personal information safe, here’s a look at how P2Ps help you avoid getting scammed:

- Venmo uses encryption, monitors accounts for unauthorized transactions and verifies the identity of certain users.

- PayPal monitors accounts 24/7 and doesn’t share all of your personal info to those you send money to.

- Cash App monitors accounts. If they suspect any fraudulent transaction, they will cancel it and return any funds within 1-3 business days.

- Zelle doesn’t offer fraud protection because transactions are done directly through banks; your bank provides the fraud protection.

- Apple Pay offers a rotating security code feature you can enable for advanced fraud protection.

- Google Pay offers fraud protection that covers 100% of all verified unauthorized transactions.

How to Protect Yourself and Money When Using P2P Apps

While all the P2P apps have security measures such as encryption and 24/7 monitoring, once you send money, it can be difficult to get your money back. For this reason, there are a few things you can do to help ensure your money and yourself when using these apps.

- Avoid scams and fraud, never send money via a peer-to-peer cash app to someone you don’t know.

- Use a PIN or two-step authentication to prevent unauthorized use of any shared devices.

- Verify and double-check all recipient information before you send money.

- Link a credit card instead of a bank account or debit card. The apps that allow you to link a credit card for funding charge a fee per transaction:

- Venmo charges 3%

- PayPal charges 2.99% plus $0.30 (there are no fees if you use Amex Send account)

- Cash App

- Report suspected scams to the appropriate customer support team via chat, contact form or phone.

- Venmo: (855) 878-6462

- PayPal: (888) 221-1161, [email protected]

- Cash App: (800) 969-1940.

- Zelle: If you suspect fraud, contact your financial institution.

- Apple Pay: Enter your contact number here, and Apple Support will call you for help with potential scams.

- Google Pay: You must fill out a form before you can contact Google Pay via email or phone.

When using trusted, established services and taking basic security precautions, these apps provide safe, convenient ways to split bills and send money to friends and family digitally.

Share On Twitter

Share On Twitter