Fresh Ideas for Real Frugal Living

What does frugal living mean? What doesn’t it mean?

Being frugal can come with some negative connotations. You may hear someone described as a frugal person and assume that means they’re cheap: They only buy the cheapest thing at the store, don’t spend money on personal luxuries, and don’t go out to eat. But being frugal doesn’t mean being cheap. It also doesn’t have to mean cutting back on the things you enjoy, just to get the most out of every dollar.

Instead, when you live frugally, you are very intentional about your money and spending. If you enjoy designer clothing or having a nice meal on Fridays, you plan your budget around these activities to maximize spending on what’s important to you.

When we talk about frugal living, we won’t assume what your priorities are. Instead, we’ll offer tips about how to be more conscious of your monthly budget and what you can do to save money in other areas of your life. With that said, here are some tips for moving toward frugal living.

Takeaway: People who live frugal lives aren’t cheap. They’re purposeful with every cent they spend.

Frugal Finances: Set a Budget

It’s easy to fall into the pitfall of “blind spending”. This is where you don’t quite keep track of how much you’re making every month as it relates to how much you’re spending. You may be earning the most you ever have in your life, but can still not have a lot of money at the end of the month. Before you cut costs, you should track your monthly spending on a spreadsheet to see exactly what areas you’re spending the most in.

List all the transactions in a spreadsheet (use Google Sheets – it’s free!) like this one that The New York Times created. This spreadsheet allows you to separate your expenditures into subsections, so you can understand what percentage of your budget is dedicated to what areas. Again, it is ok to spend more in the areas that you enjoy spending in!

The purpose of budgeting out your income isn’t to make you feel ashamed at spending a certain amount, but rather to bring awareness to how you’re spending your money. When you write your budget out, you may find that you’re spending more in a specific area than you originally anticipated. You may also find that by cutting out spending in one area, you can dedicate more to a different activity that you enjoy more.

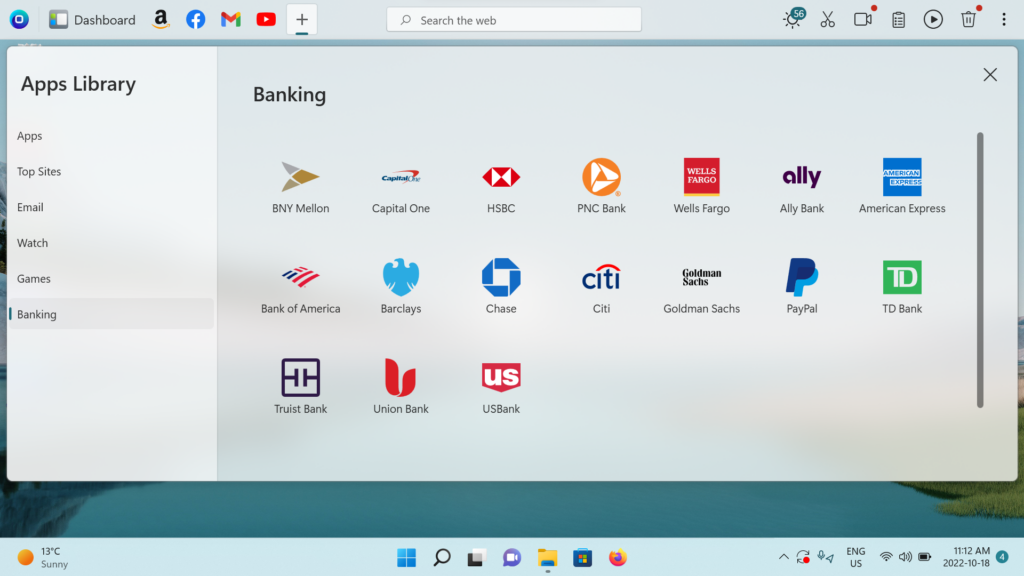

You should also keep track of where all of your money is across all of your different banking apps. Online banking can sometimes have built-in budgeting tools for keeping track of how you spend. If you’re using OneLaunch, the Apps library allows you to pin your banking apps to the dashboard so that your accounts don’t go unnoticed and neglected.

OneLaunch also has a banking section, which includes quick links to the top banks in the country. Don’t see your bank? Send us a message.

Avoid Lifestyle Creep

If you recently got a new position or a big promotion that significantly increased your annual income, you may be surprised at the end of the month when you have the same amount or less of savings money left over. This is called lifestyle creep: When your income is increasing, but the amount of spending you do increases at the same or even a higher rate.

How to avoid lifestyle creep

Even small incremental increases to your salary can result in lifestyle creep. One of the best tips is, after you’ve created a reasonable budget, set up an automatic transfer with your monthly paychecks. All the money you make should be put into a savings account first. Then, have a separate repeating monthly transfer from your savings account to your checking that’s equal to the budget that you’ve set. That way, you’re restricted monthly to the exact amount you’ve budgeted.

If you get a promotion or raise to your annual salary, it’s ok to revisit your monthly budget. But, again, the best strategy is to take the additional income and move it to savings or an investment. Out of sight, out of mind.

Ways to Be Frugal Online (Spending and Subscriptions)

Many online retailers will do a lot to make the actual cost of the product or service you’re purchasing seem intangible or heavily discounted. They’ll streamline the purchasing process (one click buy), request payment in monthly installments, or have a discount in order to make the real amount of money shrouded or seem like a great deal.

Slow down when shopping online

When making an online purchase, consider the actual amount of money that you’ll be spending as if it was physically in front of you. Eighty dollars may seem intangible when it’s the total of your online cart, but if you laid out four $20 bills in front of you, would you still make the purchase?

Additionally, consider whether the online purchase you’re making is entirely necessary. Could you find a better, cheaper version of what you’re purchasing if you shop around a bit online? Did you search for coupons first? The convenience of online shopping can be a blessing just as much as it’s a curse when making impulsive purchases. Putting in a little bit of work to consider your purchase can save a lot of money in the long run.

Lastly, consider deleting shopping apps from your mobile devices. Shop online only from your laptop or home computer. You’re slightly less likely to make spontaneous purchases when you don’t use a mobile device, according to a study on shopping habits compiled by Broadbandsearch.net. They found that 51% of all retail traffic takes place on mobile platforms, and that number is increasing year after year.

Track your subscriptions!

Many online services now charge as a monthly subscription rather than an online purchase. Even some programs like Microsoft Office and Adobe have switched over to this system to increase their profits in the long run. Online subscriptions seem cheaper in the short term, but will quickly add up over time. Although it requires a bit of work, it’s worth compiling all the different subscription services you use in a separate spreadsheet from your budgeting document and seeing just how much you’re spending every month. You may be surprised just how much that total ends up being.

Cutting out monthly subscriptions or looking for free/cheaper alternatives that offer a similar service can save a lot of money. Put reminders on your calendar when subscriptions are due to renew, giving yourself enough time to evaluate whether renewal is worthwhile.

Share On Twitter

Share On Twitter